Newly minted software engineer steps out of the lab into the world

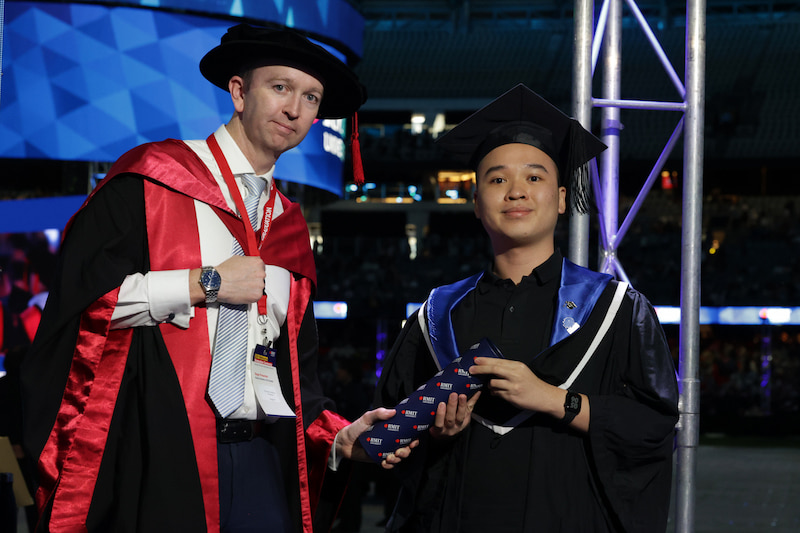

Ho Le Minh Thach never imagined himself as a software engineer. The solid academic foundation he received at RMIT Vietnam, and his experience with Harvard's computer science course, sparked his passion for programming and empowered him to pursue a career in software engineering.

Growing through competitions: RMIT graduates share their journey

Stepping outside the classroom can be intimidating, but competitions offer more than just trophies. They sharpen skills, build awareness, and open doors to real-world opportunities.

Student sets a path back to education

On a quiet runway a student took flight with belief and curiosity, and one day returned to guide others from where she began.

From uncertainty to unstoppable: The inspiring journey of Vo Thanh Hoang Anh

"As long as the wind keeps blowing, I’ll keep moving forward." These words, spoken by the School of Science, Engineering and Technology’s Class Representative Vo Thanh Hoang Anh, encapsulated a journey of transformation that was nothing short of extraordinary.